Disagreements can arise from time to time with clients. Whether they’ve missed a tax payment or submitted a document that was never signed, it is your practice’s responsibility to ensure that the correct procedures were followed, every step of the way.

Of course, it can be difficult to show written records for every single interaction with your clients, but doing so can help to protect your practice’s liability. With practice management software, tracking your clients’ activity no longer involves a heavily complex system that requires constant updating. Audit trails can track and record every piece of communication with your client in the background, so you don’t have to.

Think of audit trails like insurance for your practice; they’re available when you need them and you’ll feel relieved you’ve got them when issues arise. Here are 5 key ways audit trails can protect your practice while streamlining communication with your clients:

1. View all client activity from one location

As John Groves, former HMRC Tax Investigator stated, “It’s not very comfortable for an accountant to be sitting at a meeting with their client and a tax investigator and be given information which they thought never existed.”

That’s why it is so important to have an efficient digital audit trail in place. It provides an extra layer of protection by tracking communication across your entire practice. Whether it’s emails, texts or calls from clients, they are all recorded and accounted for.

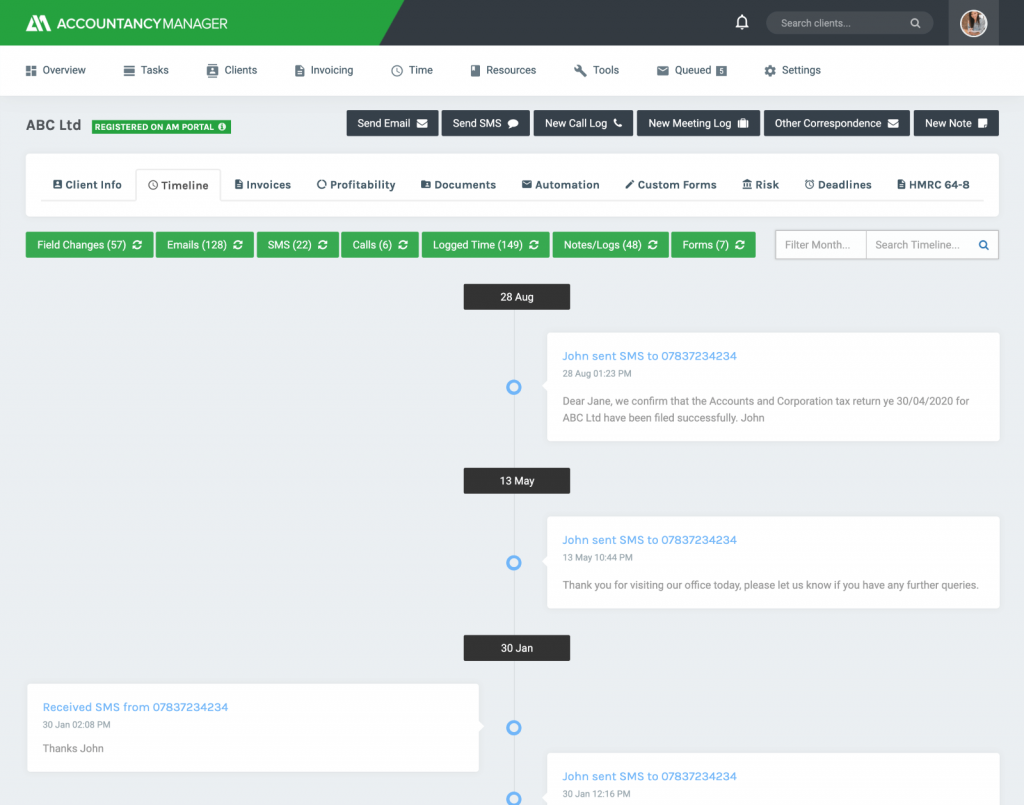

For example, in AccountancyManager, not only are emails, texts and calls tracked, but all activity within the client portal is also recorded and stored in one location, known as the Client Timeline. This includes any updates to client details or documents they’ve signed, with links to these documents provided in the Client Timeline too.

“Some clients communicate with us in weird and wonderful ways; voice notes, WhatsApp, Instagram messages. So using the Client Timeline within AccountancyManager to record their communication over and above just emails and calls is really, really useful.”

Rachel, StriveX

2. Everything is time stamped

Have clients ever been convinced that they didn’t receive an attachment in an email, or a document to sign, but you can’t remember the date that you sent these files? Not only does practice management software keep all of your communication recorded, it also time-stamps every document, signature, email, and text that your practice sends out to clients.

This provides you with the proof you need to show clients when exactly these emails were sent out, or what date your client signed an important document. To protect your liability even further, emails are also tagged when they have been opened in AccountancyManager. Take a look at AccountancyManager’s user-friendly Client Timeline in the image below.

“So when you’ve got a client saying, ‘I haven’t seen/received that email’, I can see that they’ve opened it 15 times already!”

Vicky, Creative and Numbers

3. Not just for clients, for staff too

Audit trails also have internal benefits, as the latest record of communication with the client is visible to the whole team. For instance, if a team member wants to contact a client about a particular issue – they would first check the client timeline to see if anyone else has already reached out about this issue. This communication record keeps everyone on the same (virtual) page, prevents the client from being contacted unnecessarily, and maintains a professional perception of your firm.

“I treat AccountancyManager as another member of staff, because in the background we’ve got a full audit trail of onboarding as well as all the information regarding what’s coming up.”

Ben Thexton, TAC Accountants

4. Increases your GDPR compliance

Data breaches can be more common than you think; from sending confidential information to the wrong email to distributing incorrect client details. Thankfully, with the right software in place, you can have these details securely stored in one singular location.

For example, AccountancyManager is integrated with Gmail. This means that rather than scrambling through Gmail for hours looking for a specific client’s email, it is easily retrievable within the client timeline. No need to hop between different messaging and communication platforms – they’re all accessible within AccountancyManager.

On the odd occasion a client might say, ‘well, you didn’t say that’, then rather than trawling through your Gmail, you just go back to their timeline, it’s much easier to locate that communication in AM.”

Vicky, Creative and Numbers

AccountancyManager is also integrated with Companies House. This integration streamlines the onboarding process by eliminating back-and-forth emails with new clients; all necessary information is populated directly into AccountancyManager. This not only improves your GDPR compliance by reducing the risk of a data breach, it also saves you a tremendous amount of time when onboarding a new client.

5. Increases your firm’s efficiency

With an effective and secure audit trail in place, your practice reduces its liability, saves time and improves its internal organisational structure, which ultimately increases the efficiency of your firm.

While there are a number of practice management software providers on the market, AccountancyManager is an award-winning practice management software with an unbeatable Client Timeline that offers all the points mentioned above and more.

Discover how practice management software can revolutionise your practice by booking a 30-day free trial with AccountancyManager today.