Anti-money laundering and risk

Keep your clients compliant and your practice covered with best practice risk management.

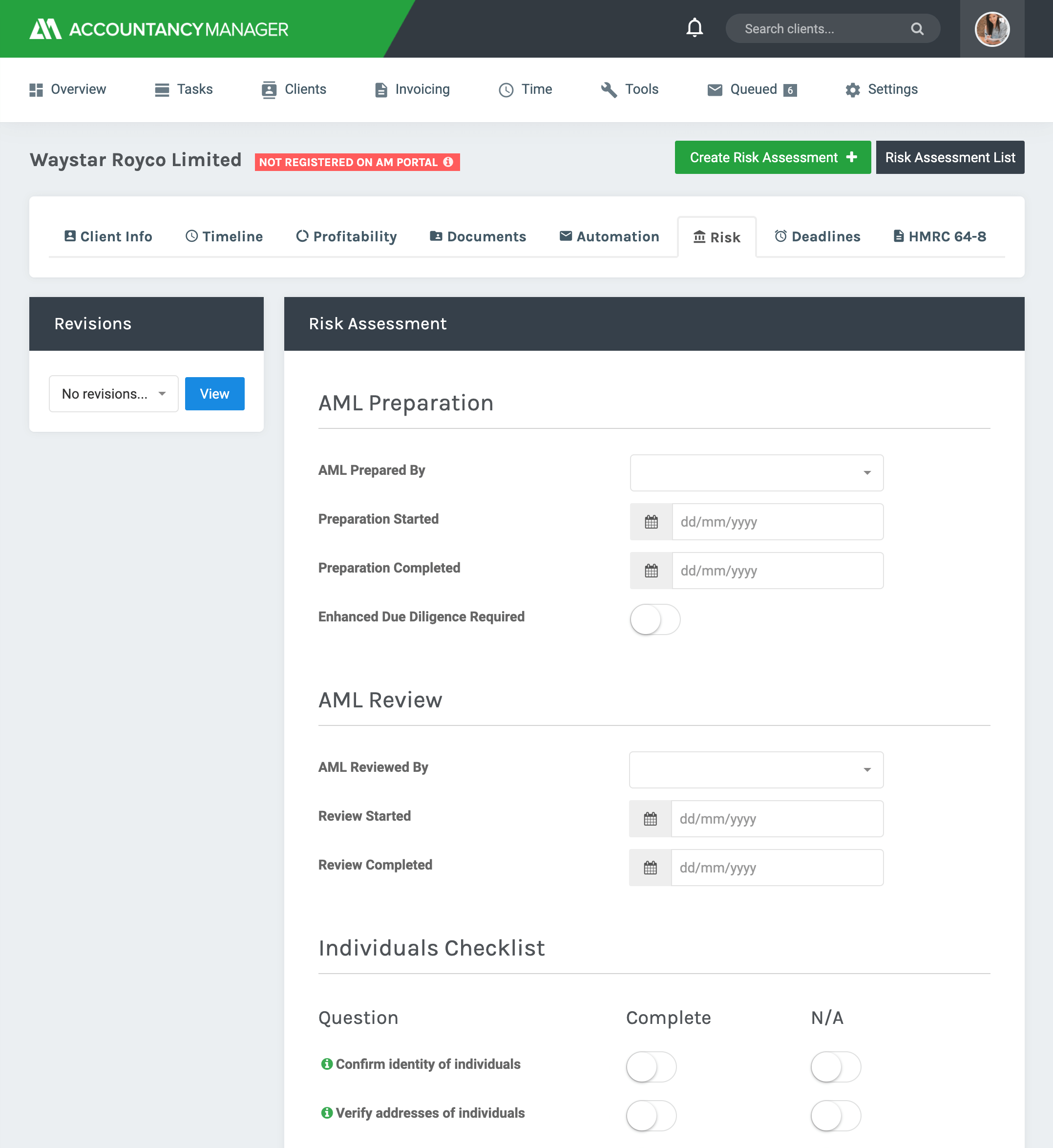

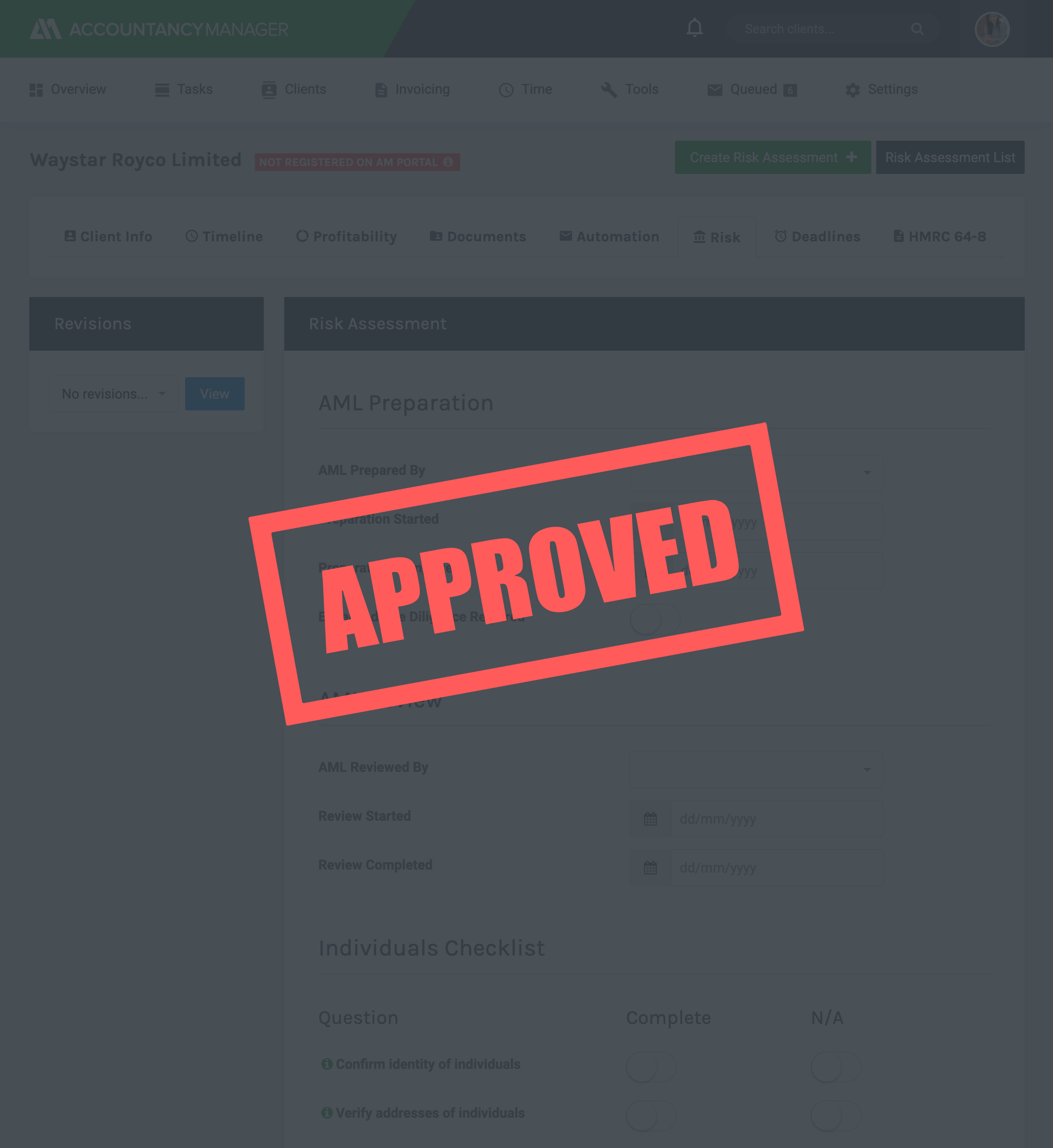

Complete and store risk assessments

Know your customer. In the Risk section on AccountancyManager, you’ll find a comprehensive risk assessment for enhanced due diligence.

"It's not very comfortable for an accountant to be sitting at a meeting with their client and a tax investigator and be given information which they thought never existed."

Give your clients a risk rating

After completing or updating risk assessments, clearly identify clients with low, medium and high risk levels.

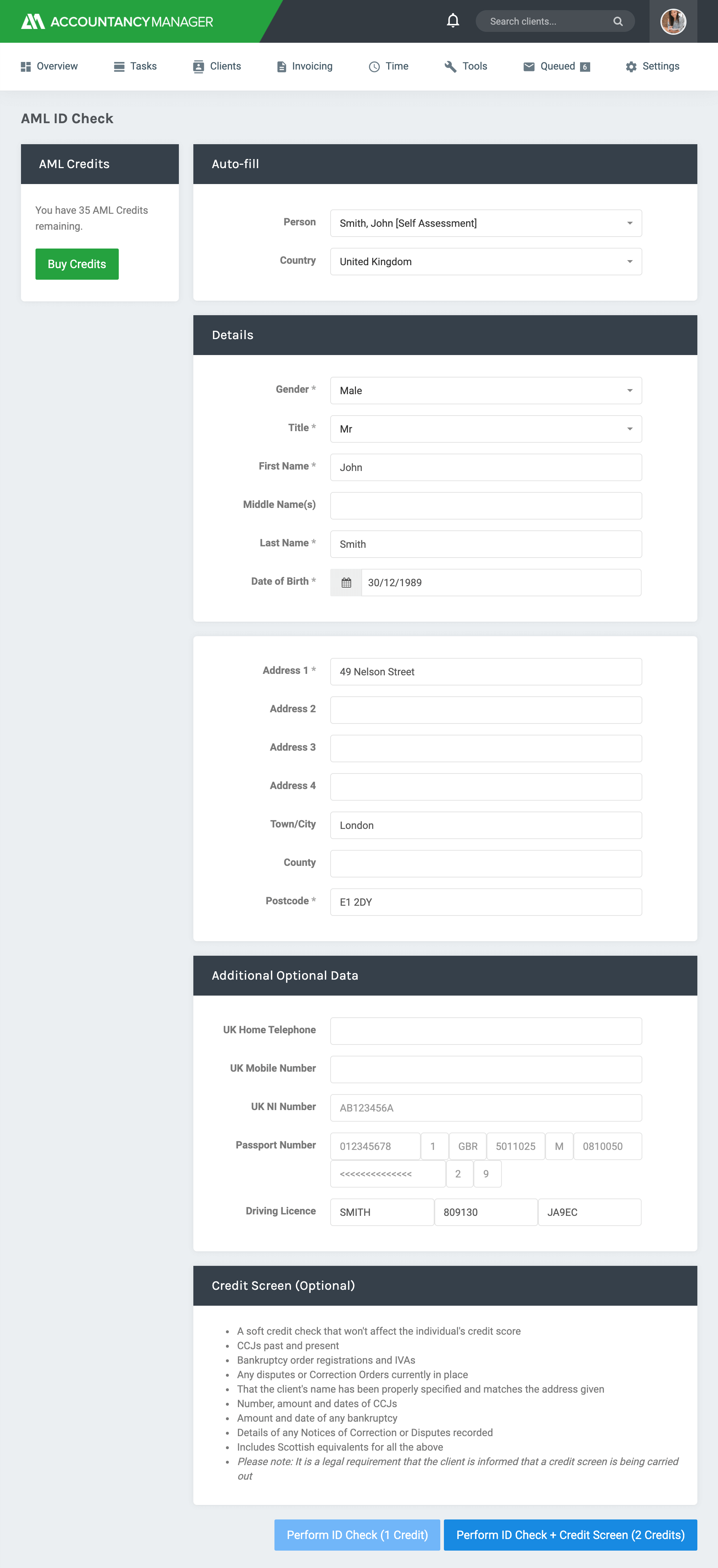

Run AML ID and credit checks

You can complete your entire anti-money laundering process for new clients through AccountancyManager, from automating requests for proof of ID to submitting your AML checks and credit screens.

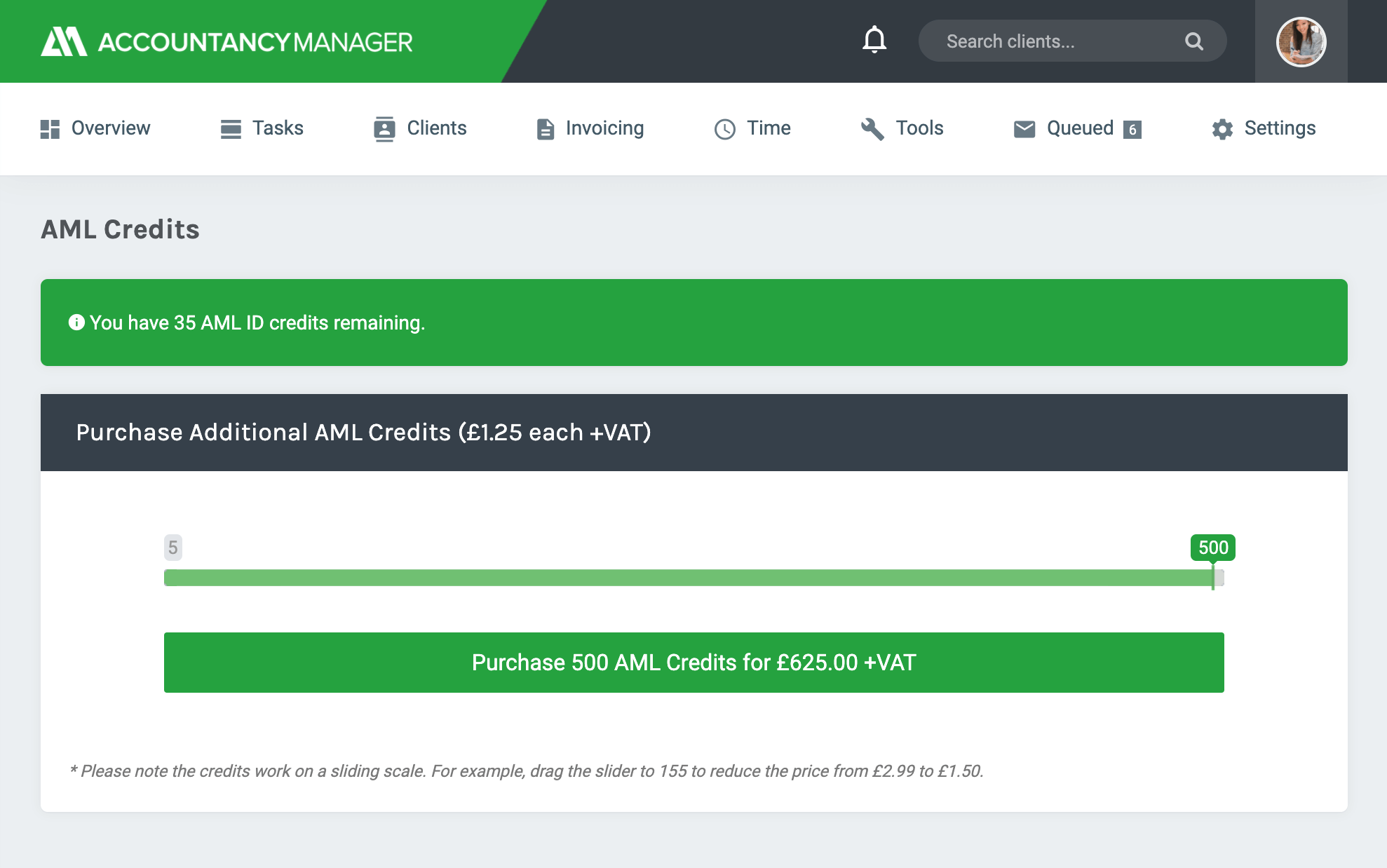

Buy credits in bulk and save

ID checks and credit screens are both one credit so if you want to complete a credit screen and AML ID check, simply use two credits instead of one. If you buy 500, each credit will cost £1.25 - the lowest cost integrated solution on the market.

Tax investigator stamp of approval

Our AML and risk features have been guided and thoroughly checked by former HMRC tax investigator, John Groves. John recommends viewing anti-money laundering as an ongoing issue, not just box-ticking at onboarding.

Strengthen your approach to anti-money laundering and risk

- In-system ID and credit checks

- Risk assessment checklist

- Risk profile ratings

- Low-cost credits

- Client timeline audit trail

- Missing details reminders

"AM completely revolutionised my practice overnight. I used to spend hours preparing..."

Find out how AM revolutionises practices by signing up today.

Sign up